Our team at Collaso Tax Services is dedicated to providing Up-To-The-Minute Tax News for your review and sharing. Please check here for updates and/or visit our Facebook & Instagram accounts for articles, resources and tips. Tap/click the + icon on the toggle to read more.

IRS Identity Protection Pins 1.22.24

Click/Tap to Read the article.

For California storm victims, IRS Postpones tax-filing and tax-payment deadline to Nov. 16th, 2023

Click/Tap to read the article.

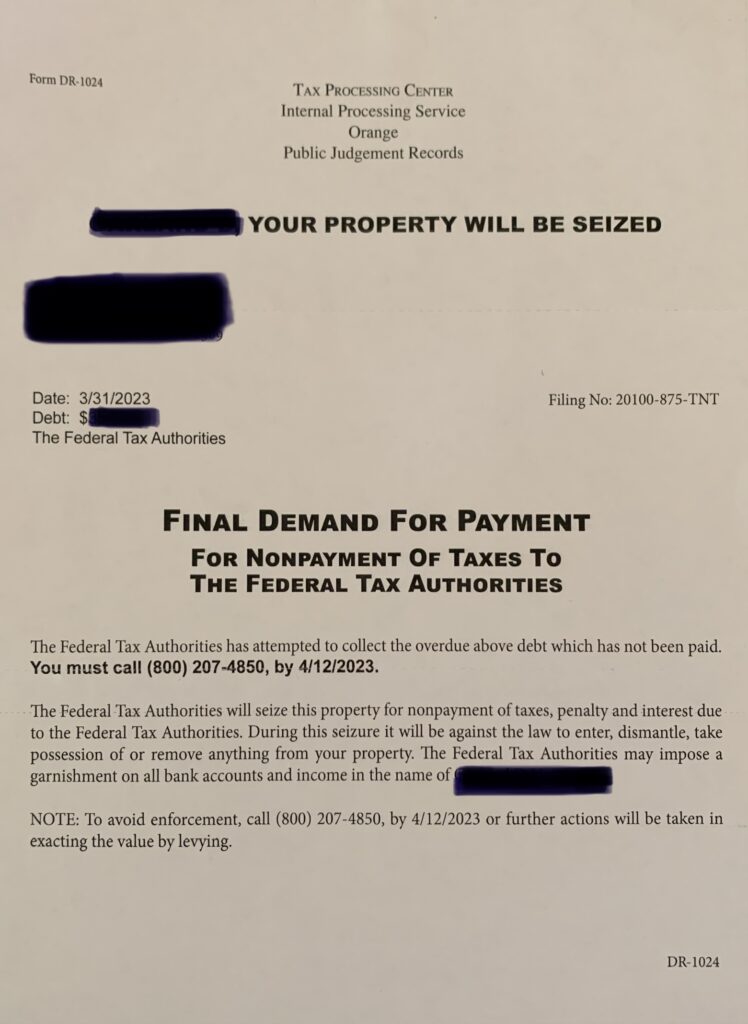

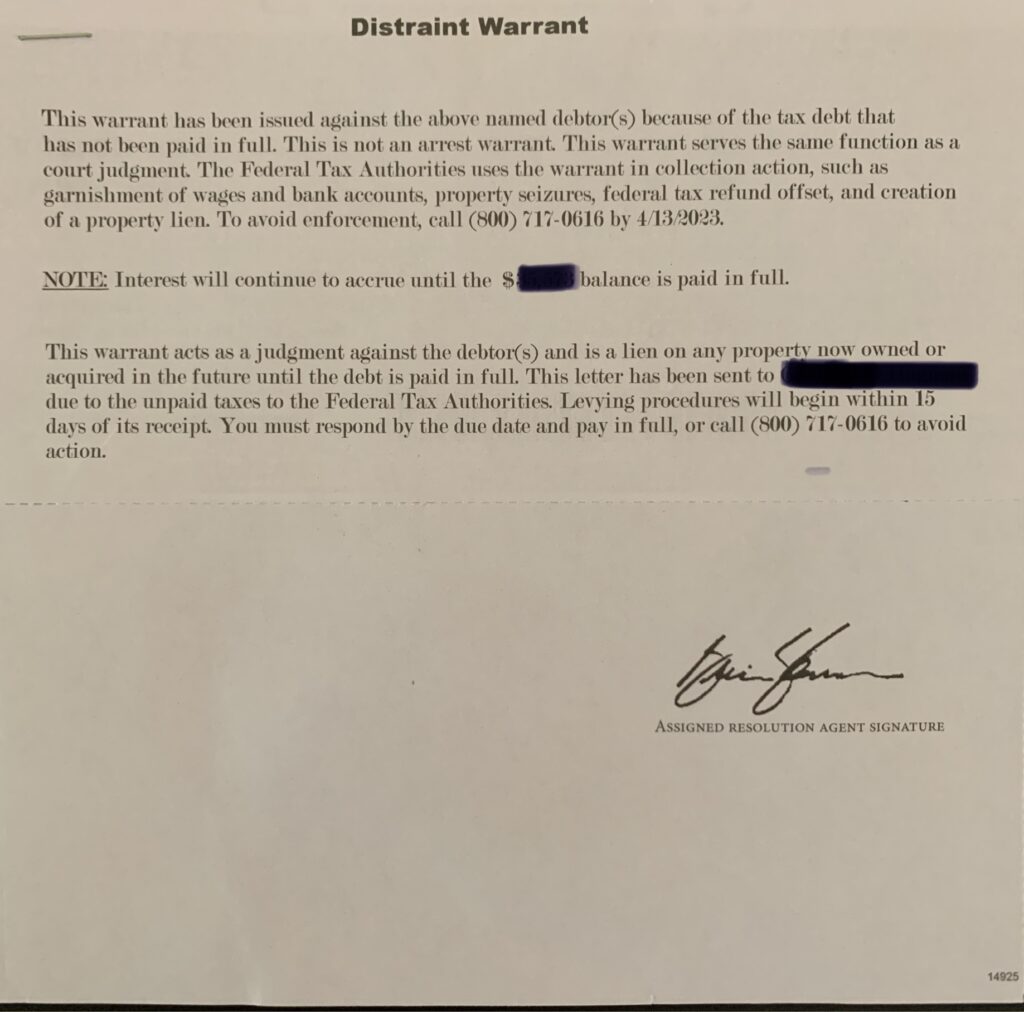

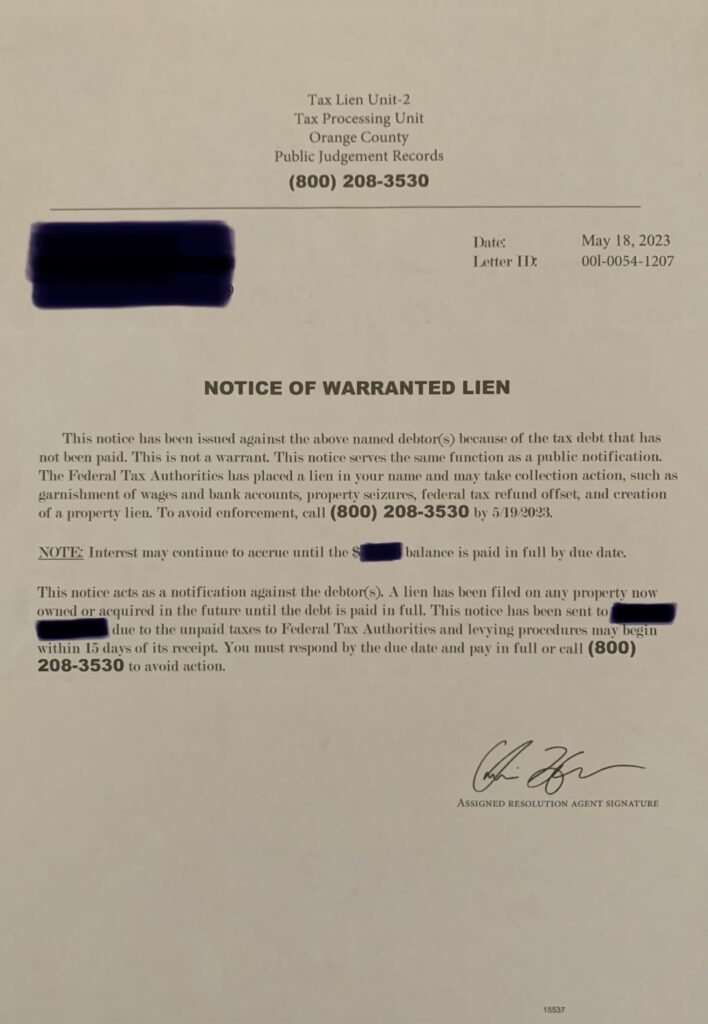

Don't Fall for Scam Letters and Calls!

Don’t Fall for Tax Scams!

Phone Calls, Mail, and eMail scams are numerous and you may see an increase with the tax extension deadline approaching.

Here are some tips to help you spot them:

🚩 Be skeptical of unexpected communication claiming to be from tax authorities.

🚩 Verify the authenticity of the message by contacting the official tax agency directly.

🚩 Watch out for requests for personal information, such as your social security number or bank account details.

🚩 Be cautious of urgent demands for immediate payment or threats of legal action.

🚩 Look out for poor grammar, spelling mistakes, and suspicious email addresses.

The IRS doesn’t initiate contact with taxpayers by email, text messages, calls or social media channels to request personal or financial information. This includes requests for PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts.

* Report all unsolicited email, mail , calls or social media claiming to be from the IRS or an IRS-related function to phishing@irs.gov

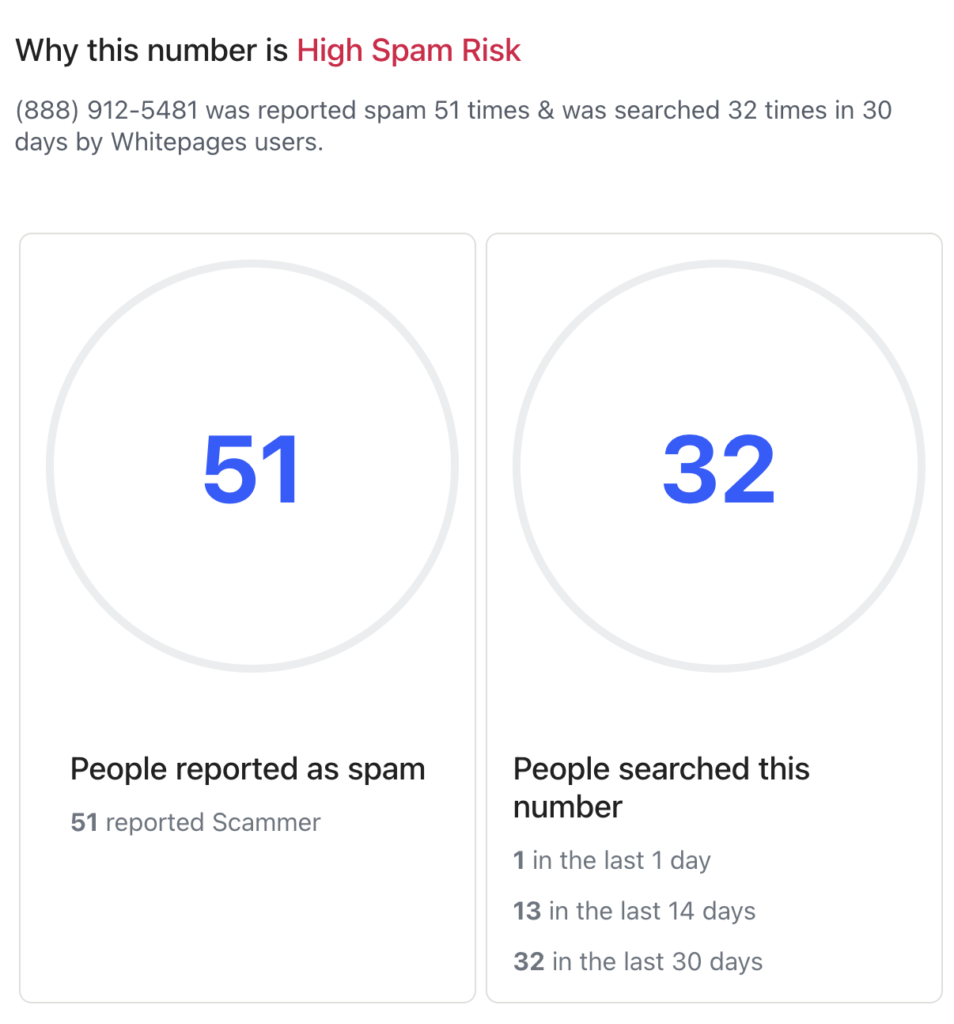

SCAM CALLS: When you report a fraudulent call, please include: the telephone number of the caller (e.g., Caller ID). Then block the number from your cell phone. You can use WHITEPAGES to reverse search phone numbers and report numbers at https://www.whitepages.com/reverse-phone By searching the number you will see if it is noted as high spam risk and you will have the option to report the number. Users will see a spam score, number of reports and comments from the Whitepages community for incoming calls identified as suspected spam.

EMAILS: Forward the eMail(s) to the phishing address above and block the eMail sender after you report it. Although the blocked sender can still deliver a message to your account, it will go to the junk or spam folder, not your inbox. It’s generally better to block spam emails rather than simply delete them. Companies will often use a 3rd party service to send these of emails. 3rd party services will usually send the emails from multiple addresses, so blocking one can still result in receiving a similar message from one of the alternate addresses.

USPS MAIL: Letters and Notices – “Understanding Your IRS Notice or Letter”

On the mail you received find the notice (CP) or letter (LTR) number on either the top or the bottom right-hand corner of your correspondence. Next, tap the link below OR copy + paste it into a new browser tab and tap enter to visit https://www.irs.gov/individuals/understanding-your-irs-notice-or-letter enter the letter or notice number via the SEARCH feature “Notices & Letters Search. If the search doesn’t find any information on the letter or notice, please report the information to the phishing address.

TIP: Scan (or shoot a pic from your mobile device) of any letters or notices you receive in the mail and report via eMail to the phishing address above.

If you are currently a client with Collaso Tax Services or plan to be in the future, please save copies and the date you reported them to the phishing eMail address, as well as any notes you document and discuss with our team. It’s always helpful to have an experienced set of eyes to guide you with scam issues and trends.

Stay vigilant and protect yourself…check back here for future articles and information that will help you navigate topics year-round.